Artificial intelligence in the Italian Banking Sector

Nell’era digitale, il ruolo dell’intelligenza artificiale (AI) nel settore bancario sta assumendo sempre più rilevanza. Tra le prime cinque banche italiane per raccolta, Intesa Sanpaolo è saldamente in testa per l’uso più frequente e sofisticato dell’AI, seguita da UniCredit, Banco BPM, BPER Banca e MPS. Questa tendenza emerge da una ricerca condotta da Excellence Consulting e Dataskills, che ha analizzato circa 10.000 articoli pubblicati dal luglio 2020 al giugno 2023 su giornali economici e generalisti italiani.

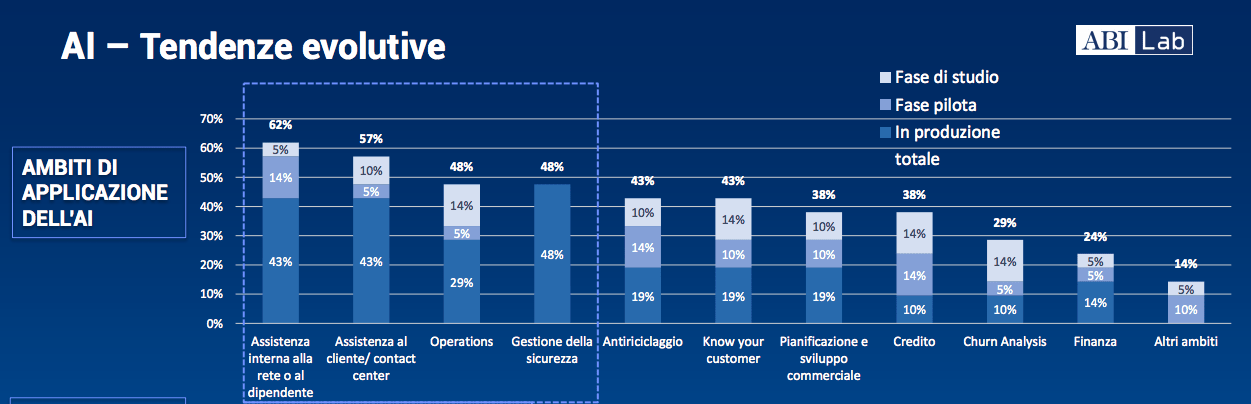

The report shows that Italian banks are leveraging AI in various areas, from optimizing the customer experience to innovating products and services, up to improving governance and risk management.

AI and the Evolution of the Banking Service Model

La ricerca sottolinea che l’intelligenza artificiale è cruciale per l’evoluzione del modello di servizio bancario. In particolare, Intesa Sanpaolo utilizza l’AI in un’ampia gamma di applicazioni che vanno dal miglioramento dell’esperienza cliente all’ottimizzazione delle strategie di marketing. UniCredit e Banco BPM sono vicini, applicando soluzioni di AI in tre delle quattro aree studiate nella ricerca, anche se UniCredit in Italia è attivo solo in due. Al contrario, BPER Banca ha iniziato ad applicare l’AI in un solo ambito, mentre MPS non ha ancora inserito l’AI nel suo piano industriale.

European Regulation and the Future of AI in the Banking Sector

Con l’approvazione della proposta di regolamento sull’AI (AI Act) da parte della Commissione Parlamentare EU a maggio 2023 e il voto del Parlamento europeo a giugno, il quadro normativo sta diventando più chiaro. L’AI Act verrà pubblicato nella Gazzetta Europea a dicembre 2023, e rappresenta un passo fondamentale per la standardizzazione e la regolamentazione dell’uso dell’AI, a cui anche le banche dovranno adeguarsi.

Artificial Intelligence as a Macrotrend in the Financial World

Maurizio Primanni, CEO di Excellence Consulting, osserva che l’intelligenza artificiale sta diventando un macrotrend nel mondo finanziario, similmente a quanto è stato per la digital transformation e più recentemente per la transizione ESG. Le parole chiave associate all’AI in generale sono ‘ricerca’, ‘sviluppo’ e ‘tecnologia’. Quando si parla di AI nel settore bancario, emergono anche termini come ‘digitale’, ‘crescita’ e ‘servizi’, che suggeriscono l’orientamento delle banche verso l’utilizzo dell’AI come strumento per rilanciare la crescita e sviluppare nuovi servizi.

Verso un Futuro Bancario più Intelligente

In conclusione, mentre alcune banche, come Intesa Sanpaolo, stanno già sfruttando l’AI in modi innovativi, altre devono ancora recuperare. Secondo Primanni, è fondamentale che le banche agiscano in modo organico e diffuso sui fattori critici di successo, che vanno dalla cultura aziendale alla governance, dalla competenza nella gestione dei dati alla compliance. Con l’introduzione imminente dell’AI Act, le banche hanno l’opportunità di prepararsi per un futuro in cui l’intelligenza artificiale giocherà un ruolo sempre più centrale.

Il settore bancario italiano sta quindi attraversando un periodo di profonda trasformazione, guidato dall’innovazione tecnologica e dall’adozione dell’intelligenza artificiale. Come sempre, le banche che sapranno sfruttare al meglio queste opportunità saranno quelle che emergeranno come leader nel nuovo panorama finanziario.