Artificial intelligence in the Italian Banking Sector

In the digital age, the role of artificial intelligence (AI) in the banking sector is becoming increasingly relevant. Among the top five Italian banks by funding, Intesa Sanpaolo is firmly in the lead for the most frequent and sophisticated use of AI, followed by UniCredit, Banco BPM, BPER Banca and MPS. This trend emerges from research conducted by Excellence Consulting and Dataskills, which analyzed around 10,000 articles published from July 2020 to June 2023 in Italian economic and generalist newspapers.

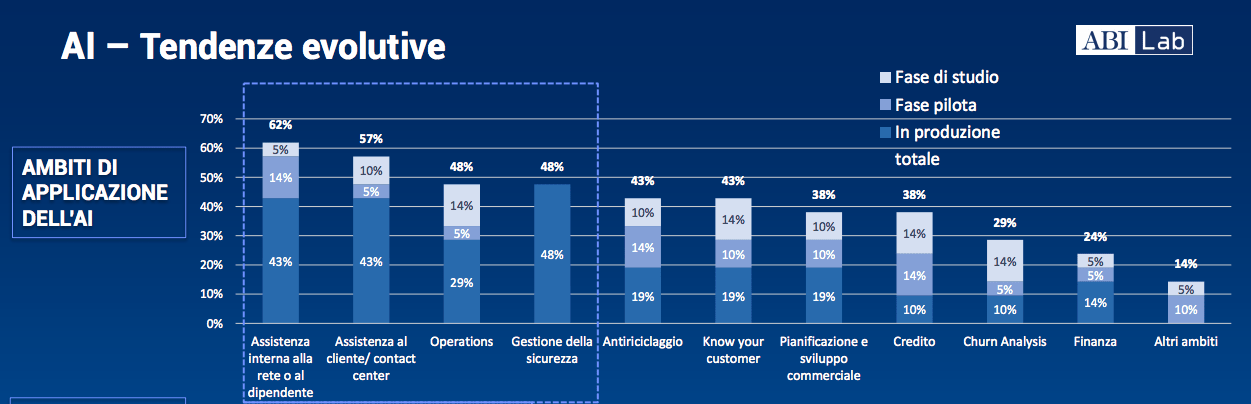

The report shows that Italian banks are leveraging AI in various areas, from optimizing the customer experience to innovating products and services, up to improving governance and risk management.

AI and the Evolution of the Banking Service Model

The research highlights that artificial intelligence is crucial to the evolution of the banking service model. In particular, Intesa Sanpaolo uses AI in a wide range of applications ranging from improving customer experience to optimizing marketing strategies. UniCredit and Banco BPM are close, applying AI solutions in three of the four areas studied in the research, even if UniCredit in Italy is only active in two. On the contrary, BPER Banca has started to apply AI in only one area, while MPS has not yet included AI in its business plan.

European Regulation and the Future of AI in the Banking Sector

With the approval of the proposed AI regulation (AI Act) by the EU Parliamentary Commission in May 2023 and the vote of the European Parliament in June, the regulatory framework is becoming clearer. The AI Act will be published in the European Journal in December 2023, and represents a fundamental step for the standardization and regulation of the use of AI, to which banks will also have to adapt.

Artificial Intelligence as a Macrotrend in the Financial World

Maurizio Primanni, CEO of Excellence Consulting, observes that artificial intelligence is becoming a macrotrend in the financial world, similarly to what has been the case for digital transformation and more recently for the ESG transition. Keywords associated with AI in general are 'research', 'development' and 'technology'. When it comes to AI in the banking sector, terms such as 'digital', 'growth' and 'services' also emerge, suggesting banks are moving towards using AI as a tool to boost growth and develop new services.

Towards a Smarter Banking Future

In conclusion, while some banks, such as Intesa Sanpaolo, are already leveraging AI in innovative ways, others have yet to catch up. According to Primanni, it is essential that banks act in an organic and widespread way on critical success factors, ranging from corporate culture to governance, from expertise in data management to compliance. With the imminent introduction of the AI Act, banks have the opportunity to prepare for a future in which artificial intelligence plays an increasingly central role.

The Italian banking sector is therefore going through a period of profound transformation, driven by technological innovation and the adoption of artificial intelligence. As always, the banks that make the most of these opportunities will be the ones that emerge as leaders in the new financial landscape.